If you’re not familiar with the You Need a Budget method, this is the very first rule of YNAB- Give Every Dollar A Job. You’re going to take the money you have right now and make a plan for that money. Maybe your balance is slim, maybe it’s fat, but this step remains the same no matter your position. The next step is to look at your bank account and see how much money you have right this minute. You’ve done a big chunk of the legwork already. Only Budget as Far as Your Money Will GoĪlright, now you’ve got a list of expenses and a rough idea of how much they cost.

Billy’s got his number! It’s not as pretty as he wanted it to be, but it’s reality. Credit card minimum: $25 (current balance: $2400 – 0% APR until Oct 2020).Medical: $0 (money comes out of his paycheck for a Health Savings Account (HSA) so he doesn’t count this in his budget).

#You need a budget jobs registration#

Car registration (license, tab renewal).Auto maintenance (oil changes, new tires).Transportation costs (gas, bus pass, tolls, parking).Other utilities (trash service, gas bill).It’s not exhaustive but it will give you a solid starting point: Look through this list to jog your memory.

#You need a budget jobs trial#

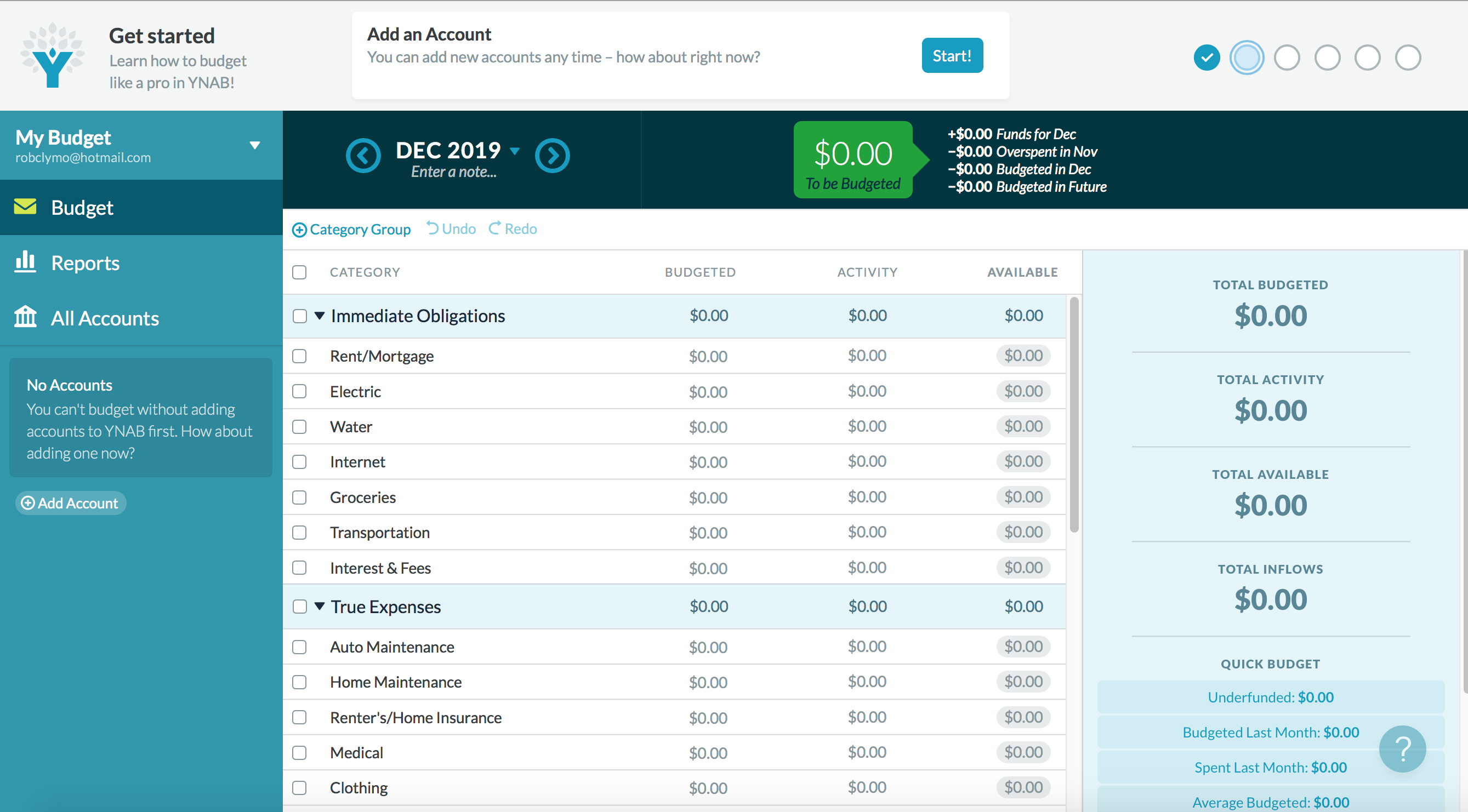

You can write this list down on a piece of paper (or use the free trial we offer in YNAB to make the rest of the steps a little easier). For now, we want the most accurate picture possible of the current state of your spending. Be super realistic with this spending: we’ll get to cutting down expenditures later. Go through credit card statements, checking account transactions, your Amazon orders in the past year, the whole nine yards.Ĭome up with a list of the categories you spend money on, and a ballpark monthly cost for each category. Make a List of Current Expensesįirst things first, answer this: how much does a month of your life cost? To get to this number, you’re going to make a big long list. It’s the key to prioritize your money, minimize financial stress, and feel more in control during an unpredictable time.Įven if you have less money than you expected, or a whole lot less than you hoped to have, you can manage the money you have in a way that will provide clarity and control. Perhaps it’s a classic response from a company called You Need a Budget, but in all earnestness, a budget can be a beacon lighting your way through uncertain times. There is so much that we cannot control right now, but we can do the best we can, and if there has ever been a time when we all needed a budget, it is now. It’s uncertain and scary, and you are absolutely not alone.Įven if your income hasn’t changed, you’re probably feeling stressed-we all are. Maybe you’ve already been laid off or put on furlough, and you’re trying to navigate your soon-to-be reduced income as fast as you can. Many of us are wondering… Is my work going to get shut down? Am I going to get paid? What if I run out of money? Peel back the layers of this Covid-19 pandemic and it’s not just a fear for our physical health (and the health of our loved ones), it’s a fear for our financial health and the future in general. A weekly dose of just the right medicine to help you get out of debt, save more money, and beat the paycheck to paycheck cycle.These are crazy times, and we’re feeling it in every fiber of our being.

0 kommentar(er)

0 kommentar(er)